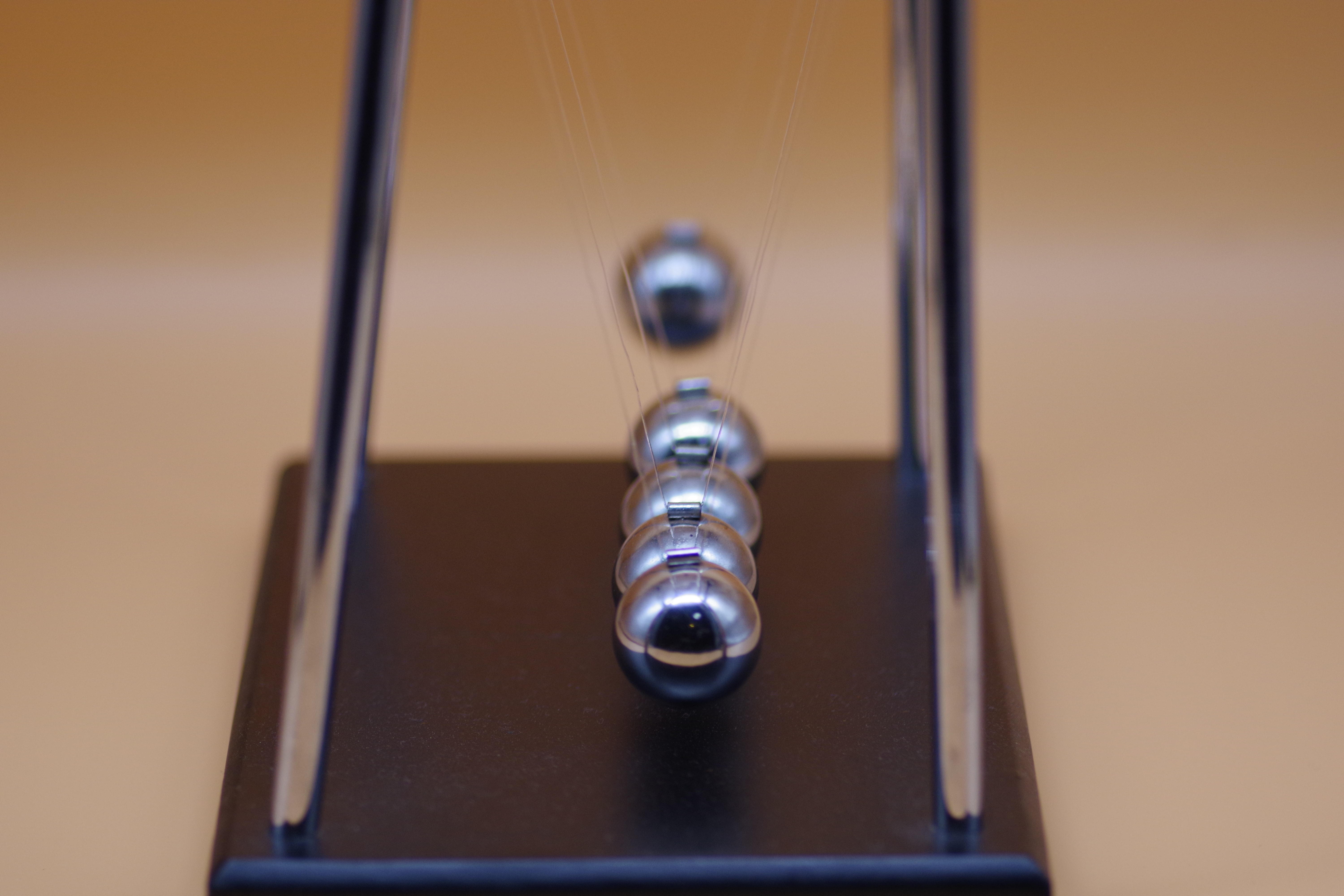

In Physics, momentum describes the relationship between speed, mass and direction. It also describes the force needed to stop objects and to keep them in motion. Great results come from powerful momentum. It’s like inertia. Once something is in motion, it keeps going unless there is friction. So how do we apply this concept to our personal finance?

Whether you’ve thought about it or not, momentum is what drives financial success. The hardest part of building momentum is getting started. Just like anything in life, taking the first step is the hardest - whether it is paying off debt, building an emergency fund, or even starting to save for retirement. You start, and it feels like you’re getting nowhere. Momentum helps you get over the initial hurdle of not being able to start something.

The sooner you get going, the easier it is to keep moving forward. Momentum helps build positive thinking. It gives you the belief that you can achieve what it is that you want to achieve in your finances. Little victories will lead to big victories. Small wins in your finances will create a snowball effect which will lead to bigger financial wins. By building momentum, you are creating a world in which you're more productive, more effective, and more efficient. Momentum is powerful!

So what can we do to ensure we keep the ball rolling and create momentum in our personal finance? I would encourage you to do the following:

- Take action; financial indecision is dangerous and paralysing.

- Build consistency; consistency in our action drives performance and positive results.

- Stay financially disciplined; this is the only way to achieve financial success.

- Never stop learning; financial education is an ongoing lifelong process.

- Surround yourself with positivity; daily connect with the right supporting network.

Creating momentum will not only help you overcome the challenges that invariably come up on your financial journey, but it will help you remain focused, clear-minded and forward-thinking rather than stagnating. It doesn’t mean that you will always have a straight and easy path to navigate, but rather your ability to nimbly move, adjust and grow along the path will be greatly enhanced.

About Nike

Oyenike Adetoye (aka Nike) is an impactful speaker, author, and personal finance expert. A Chartered Management Accountant by profession. Nike is the founder and CEO of LifTED Finance, a private financial firm that educates, coaches and supports people on their journey through financial fitness and wealth management.