Small Steps, Big Results: The Power of Consistency

As we step into a fresh chapter this new month, I want to remind you of a simple yet powerful principle that often determines success in personal finance - CONSISTENCY.

As we step into a fresh chapter this new month, I want to remind you of a simple yet powerful principle that often determines success in personal finance - CONSISTENCY.

Happy New Year! As we step into a fresh start, the concept of Financial Abundance has been resonating deeply with me.

Not too long ago, I took a trip to Wales — a 250-mile return drive in a single day.

Recently, I came across an interesting fact about sharks: when placed in a confined fish tank, a shark will grow only to around eight inches.

Let us explore the critical topic of Estate Planning, with a special focus on Wills, Intestacy, and Trusts.

I was deeply inspired by some of the events at the Paris 2024 Olympics.

An emergency is an urgent, unexpected situation that poses an immediate risk to health, life, property, or the environment.

This month, we will explore the term “VIBECESSION.” This word has emerged to describe periods of economic and social uncertainty, where the general sentiment is more negative due to economic downturns, political instability, or global crises.

In our pursuit of success and fulfilment, the concept of wealth often conjures images of financial abundance and material possessions.

Today's blog addresses a topic many people are eager to gain more insights on: INHERITANCE TAX.

Today, we will focus on a key driver of Financial Independence – your ‘Savings Rate’.

Estate planning means working out how you’d like your assets to be managed and passed on after your death.

Geoarbitrage is the practice of taking advantage of lower costs of living in different parts of the country or even the world.

As the clock strikes midnight, a symbolic transition takes place - the old year bids farewell, making way for the untrodden paths of the new.

Have you ever noticed that when you are not actively looking for something, it seems to elude you, but the moment you start paying attention, it suddenly appears everywhere?

Investing in the stock market can feel like an overwhelming endeavor, but there is a powerful tool at your disposal that can help you achieve your financial goals with simplicity and efficiency: INDEX FUNDS.

Let us addresses a question I have been frequently asked lately: “Is it better to save rather than invest, especially now that interest rates are high?

Have you heard about the FIRE movement? It's an acronym for Financial Independence Retire Early; a lifestyle movement gaining traction among individuals who aspire to break free from the traditional notion of retirement.

The Pareto Principle, also known as the 80/20 rule is a concept that states that: “In many situations, approximately 80% of the effects or results come from 20% of the causes or inputs.

Today, I will be addressing a topic I find very intriguing.

The Law of Saving states that: “Financial freedom comes to people who save 10 percent or more of their income throughout their lifetime.

With bills climbing and costs soaring daily, the time has never been right to discuss the subject of ‘Earning More Money”.

I cannot tell you how many times in my personal life I have run short on funds.

Growing up, money was a scarce resource in our humble household.

Kaizen is a Japanese business philosophy that focuses on small incremental continuous improvements.

A financial plan seeks to identify our financial goals, prioritise them, and then outline the exact steps that we need to take to achieve those goals.

‘Spending Shocks’ is subject area that is very important and also very relevant in the current season of rising prices.

It has been a challenging couple of weeks for the economy.

In these uncertain times, it is more important than ever to make sure your finances are in order.

There is so much going on in the world right now with the economic downturn and cost of living crisis.

Here are five money management tips that will help yu improve your finances.

I recently came across a powerful tweet by @shl on Twitter.

A friend recently shared a story about the Chinese bamboo tree with me.

In everyday language, resiliency is the ability to carry on despite life’s challenges and setbacks.

From a personal finance perspective, trusting the process means truly believing that the end result of your financial goal will be worth all the struggles that you have to face throughout the process of getting there.

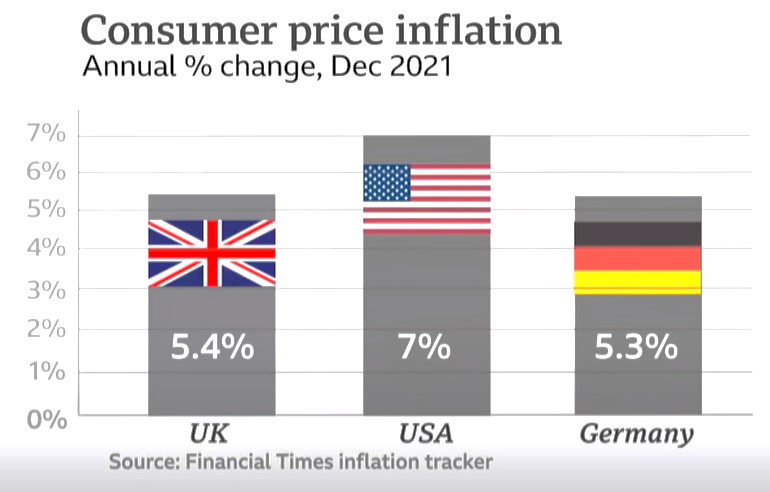

Inflation is here! In case you are not familiar with this nine-letter word, it's an economic term describing the sustained increase in prices of goods and services within a period.

“Loving yourself isn’t vanity. It’s sanity.” - Katrina Mayer. Self-love was perhaps the biggest cliché of 2021, right up there with gratitude and positivity.

In Physics, momentum describes the relationship between speed, mass and direction.

Do you look at your account at the end of the month and think ‘Where in the world did all my money go?

Today, I will be sharing two words that have kept me going strong this year.

“Procrastination is the thief of time”. Have you heard this phrase before?

It’s better to pay for unexpected expenses with your emergency fund than to borrow money.

One key difference between those that consistently experience financial success and those who don't is this thing called time management.

“If you don't find a way to make money while you sleep, you will work until you die.

If you ask people what’s the most complicated part of managing their finances, many (if not most) will tell you it’s investing.

I’m on a mission this year to encourage everyone that crosses my path to invest.

Today is uniquely special, it’s the first day of spring (1st of March).

No matter what your goals are for this year 2021, there are some fundamental basics that can be followed for a successful year financially.

I’m currently writing my 9th book. This one is all about ‘INVESTING’ – so exciting!

Happy New Year! The beginning of a new year is always a time of reflection.

Many people believe that courage is something you’re born with. And yes, there are some people who are born braver than others.

Financial planning is a comprehensive ongoing process which encompasses your current finances, your financial goals and the strategies you’ve set to achieve those goals.

I recently looked at a vision board I made for myself in 2017 and I marvelled at the awesomeness of the power of visioning.

Passive income is money that flows into your pocket while you are sleeping.

At some point in my life, I was saddled with so much debt – car repayment, credit card debt, you name it.