Inflation is here! In case you are not familiar with this nine-letter word, it's an economic term describing the sustained increase in prices of goods and services within a period. Inflation erodes purchasing power or how much of something can be purchased with currency. For example, if you had £1 to spend roughly 20 years ago, you would have been able to buy more with it then than you would today.

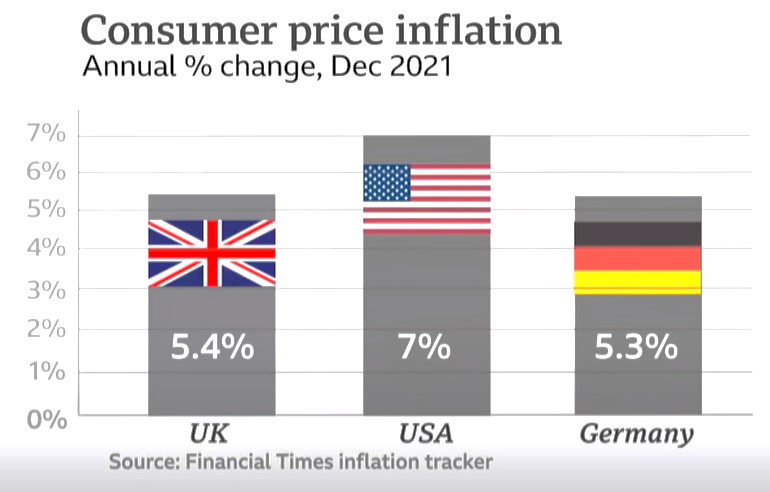

The current rising inflation is global, with the USA standing out at 7% YoY. In the UK where I live, inflation has risen to the highest level in almost 30 years at 5.4% and several measures are still expected to hit the UK households in a few months. E.g. regulated rail fares will rise by 3.8% in March, TV and broadband prices are also due to increase. In April, companies, workers and the self-employed will start paying an additional 1.25% in NI contributions under the Health and Social Care Levy. We’re likely to also see a substantial rise in gas and electricity bills. Inflation is at an all-time high!

So what can we do to reduce the impact of inflation and protect our money from its effects? Here are some tips:

1️⃣ Negotiate lower prices on everyday expenses:

To counteract higher prices, you can negotiate a better deal on almost anything. There is no harm in negotiating the APR on your credit card, or asking for discounts on your recurring costs like streaming services, insurance premiums, telephone plans, gym memberships, etc. If you don’t ask, you don’t get!

2️⃣ Follow a budget:

I can’t overemphasise the importance of having a monthly budget. Get into the habit of putting together a budget and focus especially on the expense categories that inflation affects e.g. transportation, food, utilities, etc. Think about ways to stretch your budget further, such as shopping at less expensive stores or buying in bulk. Also, consider expenses you can cut or reduce without affecting your quality of life.

3️⃣ Renegotiate your large debts:

If you are a borrower in a high-inflation environment, you can actually come out ahead. A great way to combat rising prices is to fix your low-interest rate debts. You can achieve this if you are a homeowner by refinancing your mortgage to a fixed rate. Having a mortgage with a fixed interest rate means your mortgage bill, which is normally one of the larger costs in your budget, will not go up with inflation.

4️⃣ Diversify your investments to hedge against inflation:

To maintain your purchasing power over the longer term, determine the right assets for your investments by considering your income, expenses, risk tolerance, and time horizon. Over a very long period of time, a properly diversified portfolio, which includes equities, real estate, and precious metals like gold, will provide the needed return to combat inflation.

5️⃣ Don't just save money, also invest it:

Inflation is one reason many people don't put all their money in the bank. Over time, inflation will erode the value of those savings. Apart from emergency savings which I recommend you leave in a high-interest savings account, consider investing your other savings to beat inflation. Investing inevitably involves some risks, but you can choose investments that are appropriate for your risk tolerance.

About Nike

Oyenike Adetoye (aka Nike) is an impactful speaker, author and personal finance expert. A Chartered Management Accountant by profession. Nike is the founder and CEO of LifTED Finance, a private financial firm that educates, coaches and supports people on their journey through financial fitness and wealth management.